The Connected Aircraft Market is being driven not only by demand but by technological innovation in aircraft connectivity, data analytics, IoT, and satellite communications. In this post we explore how tech is redefining the size, growth and value-chain of the industry.

Technology-Driven Growth & Trends

Innovations such as onboard IoT sensors, cloud computing for real-time analytics, and high-speed satellite links (especially Ka-band) are transforming aircraft into connected data platforms. According to the market analysis, by 2025, each aircraft could generate over 2.5 petabytes of data annually—underlining the importance of connectivity and analytics. These technological capabilities underpin market growth, attracting investments into both systems (hardware) and solutions (software/analytics).

Market Size Implications

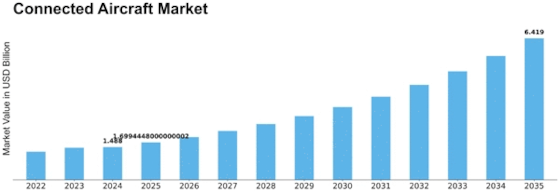

As aircraft become smarter and more connected, the overall market size will expand significantly. From USD 1.488 billion in 2024 to USD 6.419 billion by 2035 reflects how technology adoption is scaling. The more connected the aircraft, the higher the demand for integrated solutions, network infrastructure, secure data links, and analytics platforms.

Industry Analysis: Systems vs Solutions

The systems segment (avionics, communication modules) is currently dominant in terms of share, but solutions (data analytics, software platforms) are growing at a faster pace. For technology providers, this signals a shift: from simply selling hardware to offering full-stack connectivity solutions, including predictive maintenance, passenger services, and operational analytics.

Connectivity Modes & Frequency Bands

-

Connectivity modes such as in-flight satellite links remain largest, but air-to-ground connectivity is gaining traction for cost-efficiency and continuous data.

-

On frequency bands: Ka-band holds dominance due to higher bandwidths, while Ku-band is an emerging alternative, offering trade-offs in cost vs performance.

FAQs

Q1: What is pushing the connected aircraft market technologically?

A1: Key technological drivers include IoT sensors aboard aircraft, high-speed satellite connectivity (Ka-band/Ku-band), data analytics platforms, cloud computing, and regulatory support for connectivity.

Q2: Which segment is growing fastest: systems or solutions?

A2: While systems currently hold the largest share, the solutions segment (software, analytics, services) is experiencing faster growth.

Q3: What role do frequency bands play in market growth?

A3: Frequency bands like Ka-band and Ku-band are fundamental because they determine data rate, cost, coverage and hence adoption of connected aircraft services. Ka-band leads in share, Ku-band is emerging.

Conclusion

Technology is the linchpin of the Connected Aircraft Market Trends. As aircraft evolve from mere transportation devices to data-rich, connected platforms, the market size and growth trajectory follow. For technology firms, airlines, and regulators alike, understanding these innovations and their implications is essential to succeed in this industry.