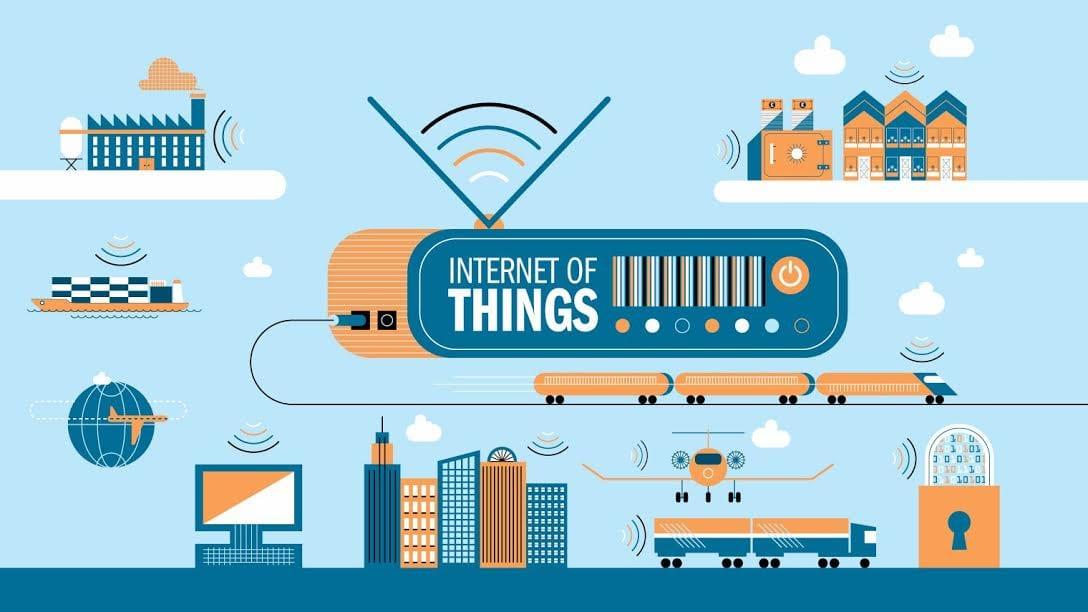

The Indian Internet of Things (IoT) market has transformed into a bustling and strategically critical arena, underpinned by a diverse ecosystem of participants. A detailed analysis of the leading India Internet of Things Market Companies reveals a complex, multi-layered structure comprising telecommunication giants providing the connectivity backbone, global hyperscale cloud providers offering the data processing and analytics platforms, a formidable tier of domestic IT services firms acting as system integrators, and a vibrant startup scene developing niche applications. These companies are collectively building the nervous system of a 'Digital India', enabling solutions that are revolutionizing sectors from manufacturing and agriculture to logistics and smart cities. The market's immense potential is reflected in its staggering growth projections. The India Internet of Things Market size is projected to grow USD 351.27 Billion by 2035, exhibiting a CAGR of 12.02% during the forecast period 2025-2035. This phenomenal expansion is being fueled by a confluence of powerful catalysts, including the world's most affordable mobile data rates, rapidly increasing smartphone penetration that doubles as a gateway for many consumer IoT applications, strong government-led initiatives like the 'Smart Cities Mission' and 'Make in India', and a pressing need across industries for enhanced operational efficiency, predictive maintenance, and real-time data visibility, making IoT a cornerstone of India's ongoing economic transformation.

The foundational layer of the Indian IoT ecosystem is provided by the telecommunications operators and the global cloud hyperscalers. Telco giants like Reliance Jio, Bharti Airtel, and Vodafone Idea (Vi) are pivotal, providing the essential connectivity fabric—spanning 4G LTE, 5G, and specialized low-power wide-area networks (LPWAN) like NB-IoT and LTE-M—that allows billions of devices to communicate. Jio, in particular, has been a major catalyst, building a nationwide NB-IoT network and an ecosystem of partners to drive adoption in areas like smart metering and asset tracking. In parallel, the cloud providers—Amazon Web Services (AWS), Microsoft Azure, and Google Cloud—offer the indispensable backend infrastructure. Their IoT platforms (AWS IoT Core, Azure IoT Hub, Google Cloud IoT) provide the scalable services for device management, data ingestion, storage, processing, and advanced analytics. They are the "brains" of the operation, enabling enterprises to derive meaningful insights from the torrent of data generated by IoT sensors. These hyperscalers are investing billions of dollars in building data centers within India to address data sovereignty requirements, making their platforms the default choice for the vast majority of IoT deployments in the country, from startups to large conglomerates.

The crucial bridge between the foundational technology and real-world business applications is built by India's world-class IT services industry and a thriving startup ecosystem. System integration (SI) behemoths like Tata Consultancy Services (TCS), Infosys, Wipro, and HCL Tech are the primary orchestrators of large-scale enterprise and public sector IoT projects. Their role is to design, develop, integrate, and manage end-to-end solutions. For example, they might lead a 'Smart City' project, integrating sensors for traffic management, smart lighting, and waste management, and building a central command center on a cloud platform. Their deep domain expertise in various industries, combined with their vast pool of engineering talent, makes them indispensable partners for any complex IoT implementation. Alongside these giants, India's vibrant startup scene is a hotbed of innovation, creating specialized IoT solutions for specific problems. These startups are developing everything from soil moisture sensors for precision agriculture and wearable health monitors for remote patient care to sophisticated telematics platforms for fleet management. These nimble and focused companies are often at the cutting edge, driving innovation in specific verticals and often becoming acquisition targets for larger players looking to expand their capabilities, thus completing the dynamic and multi-layered structure of the Indian IoT market.

Top Trending Reports -

Mexico Enterprise File Synchronization Sharing Market