The maritime transport sector is entering a phase of electrification, and at the heart of this transformation is the electric ships market. The report from (MRFR) outlines the current state, segmentation, and potential of this market with fresh data.

Industry Landscape

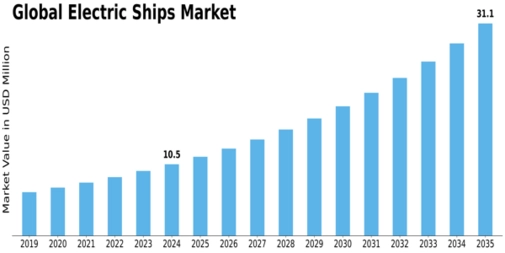

The electric ships market is growing rapidly as the shipping industry responds to global pressures to reduce carbon emissions, lower operating costs, and embrace new propulsion technologies. According to MRFR, the market size in 2024 is estimated at USD 10,500.86 million, with expectations to reach USD 31,155.85 million by 2035. The forecasted CAGR from 2025 to 2035 is 10.39%.

While essential for sustainability, this growth also reflects the rising urgency among operators and regulators to shift away from conventional diesel-based marine systems.

Market Dynamics & Key Drivers

One of the chief market drivers is rising fuel prices. With maritime shipping being fuel-intensive, electrification offers long-term cost savings.

Equally important are environmental regulations. The IMO’s sulphur and greenhouse-gas targets push shipping companies toward electric or hybrid vessels.

Technological innovation—especially in battery systems—is enhancing energy density, enabling longer ranges, faster charging and lower costs.

In parallel, infrastructure investments—for example, port-side charging stations and green shipping corridors—are creating the ecosystem required for electric ships to gain wider adoption.

Segmentation Insights

A deeper dive into segmentation reveals specific areas of growth:

- Type: Hybrid systems currently dominate (around ~90% share in 2022) as shipbuilders transition from diesel to full electric.

- System: Energy storage systems (i.e., batteries) lead within the system segment, indicating that energy-storage innovation is critical.

- Ship Type: Commercial vessels (cargo, passenger, others) dominate versus defense vessels, driven by rising seaborne trade and tourism.

- Range: Ships with > 1,000 km range take the lion’s share (2022) because this includes large vessels like container ships, tankers, bulk carriers and destroyers.

- Power: 75–150 kW systems dominated the power segment in 2022; these are suitable for medium-sized vessels including tugs and ferries.

- Operation & End Use: Manned operation remains dominant and Newbuild & Line Fit leads retrofits, signifying that many vessels are being designed electric from the outset.

Key Players in the Market

The competitive landscape is dynamic. Leading players include AKASOL AG, Anglo Belgian Corporation NV, ABB, Echandia Marine AB, Siemens AG, BAE Systems plc, Corvus Energy Inc., General Dynamics Electric Boat, KONGSBERG MARITIME AS, MAN Energy Solutions SE, Wärtsilä Corporation and others. These companies are active in innovation, partnership, geographic expansion and system integration to capture growing demand.

Regional Outlook

Growth is not uniform globally. Europe accounted for about 51.7% of the electric ships market Share in 2022. North America is the second-largest market, while Asia-Pacific is expected to grow fastest, backed by emerging shipbuilding hubs such as China and India, as well as rapid maritime trade growth.

This regional diversity signals that companies must tailor strategy by geography: European regulatory leadership, North American technology adoption, and Asia-Pacific scale growth opportunities.

Conclusion

In sum, the electric ships market is entering a phase of accelerated growth driven by regulatory, cost and technological pressures. Understanding industry segmentation and regional dynamics is key for players—whether they are vessel manufacturers, system suppliers, or maritime operators—to secure their place in this evolving landscape.

Related Report:

Military Tank Containers Market

Aerospace Flight Control System Market

Maritime Patrol Aircraft Market