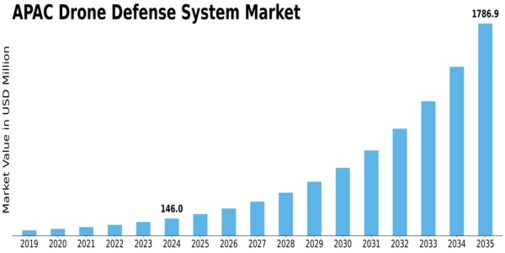

The Asia-Pacific drone defense system market is transforming rapidly as regional governments and private industries confront the growing challenges posed by unmanned aerial systems. With drones now accessible to the masses and increasingly capable of long-range flight, AI-enabled navigation, and payload transport, the need for effective counter-drone solutions has surged. According to MRFR data, the APAC drone defense system market size is projected to grow from USD 146 million in 2024 to USD 1,786.9 million by 2035, registering a powerful CAGR of 25.57% across the forecast period. This strong trajectory highlights how essential drone defense has become to protect sensitive assets and maintain national security.

One of the core accelerators driving market growth is the modernization of APAC’s defense infrastructure. Nations such as India, China, Japan, and Australia are rapidly upgrading their military surveillance systems to combat new-age drone threats, including swarm attacks, cross-border reconnaissance missions, and electronic warfare attempts. Defense agencies across the region are integrating RF jamming systems, 3D radars, command-and-control centers, and directed-energy weapons, creating a highly responsive counter-UAS ecosystem. Technological improvements have enabled these defense systems to track multiple drones simultaneously, detect low-altitude threats, and neutralize autonomous drones lacking RF signatures — a capability increasingly required as drones become stealthier and more agile.

Commercial and civilian sectors are also emerging as significant contributors to market growth. Airports in APAC have witnessed multiple cases of drone incursions, causing flight delays, shutdowns, and operational disruptions. Critical infrastructure — such as oil refineries, power plants, seaports, manufacturing facilities, and data centers — is equally vulnerable to surveillance or sabotage attempts via drones. As a result, these sectors are integrating advanced perimeter security technologies with comprehensive counter-drone systems to mitigate risks. The adoption of smart-city development projects, particularly in Japan, Singapore, India, and South Korea, is further accelerating the demand for drone detection systems to ensure public safety in crowded urban environments.

In terms of system types, identification, detection, and tracking technologies remain the largest market segment. These include radars capable of detecting micro-UAVs, RF analyzers that decode drone communication frequencies, and AI-powered video analytics. Meanwhile, countermeasure systems — such as jammers, signal disruptors, and high-energy lasers — are gaining traction as countries adopt more assertive drone-neutralization strategies. The trend toward integrated counter-UAS platforms is expected to dominate the market’s evolution, as users prioritize efficiency, automation, and centralized situational awareness.

Looking ahead, the APAC drone defense system market will continue its upward trajectory as threat levels evolve and drone misuse escalates. Increasing geopolitical tensions, border conflicts, and national security concerns will maintain defense investment levels. Meanwhile, technological breakthroughs such as autonomous counter-drone patrols, AI-enhanced threat prioritization, multisensor fusion, and electronic attack capabilities will expand the region’s market share. With APAC positioned as one of the fastest-growing drone defense hubs globally, the coming decade will redefine its strategic defense capabilities and technological leadership.

Related Report:

Related Report: