The global super-abrasive market is one of the key enablers of the modern precision manufacturing era. Super-abrasives – typically defined as ultra-hard materials such as diamond and cubic boron nitride (CBN) – play a critical role in high-end grinding, cutting, lapping and finishing operations across automotive, aerospace, electronics and industrial sectors. This blog examines the market by material type , end-user industry , application , and geography , and draws out the underlying dynamics and future outlook.

Material Type: Diamond vs CBN

Among the two principal material types in the super-abrasive space, diamond remains the leading workhorse. Its exceptional hardness, thermal conductivity and wear resistance make it ideal for cutting and grinding a wide range of substrates, including non-ferrous metals, composites, ceramics and glass. Indeed, many reports note diamond commanding a majority share of the market in recent years driven by these performance attributes. Astute Analytica +3 Data Bridge Market Research +3 Grand View Research +3

However, the story of cubic boron nitride (CBN) is compelling in its own right. While its hardness is slightly less than diamond, its thermal stability and chemical compatibility with ferrous metals give it distinct advantages – especially for machining hardened steels, gear components, and transmission parts. Reports show CBN is growing at a faster pace compared to diamond in many segments. Data Bridge Market Research+1

In practice, one can think of diamond as the broad-use premium material for general high-precision machining of non-ferrous and advanced materials, while CBN is the specialist for hardened ferrous and high-end applications. The market is therefore bifurcated: large base demand for diamond, but strong growth impetus for CBN as manufacturing shifts toward tougher substrates and tighter tolerances.

End-User Industry: Construction, Transportation, Oil & Gas, Electrical & Electronics, Others

Super-abrasives serve a wide array of end-users, but certain industries stand out.

Transportation (Automotive, Rail, Shipbuilding)

The transportation sector is a major consumer of super-abrasives. In automotive manufacturing, for example, engine components, transmissions, gears, bearings, and structural castings all require ultra-precise surface finishes and minimal tolerances. The growth of electrification (EVs) adds another dimension: battery modules, motors and lightweight components require new materials and new machining challenges, which in turn fuel demand for super-abrasive tools. Reports indicate the automotive/transportation segment has been a top driver of demand. Strategic Market Research

Construction

While perhaps less discussed than automotive and electronics, the construction sector uses super-abrasives in concrete/stone-grinding, cutting architectural glass, and heavy-equipment component machining. Growth in infrastructure, particularly in emerging markets, provides tailwinds here. Grand View Research

Oil & Gas

The oil & gas sector demands high-performance tools for drilling, maintenance and heavy-machinery fabrication – often under harsh conditions. Super-abrasives, especially CBN tools, are well-suited to cutting, grinding and finishing high-strength alloys and composite materials used in this sector. While smaller in share compared to automotive or electronics, it remains a strategic segment. Reanin

Electrical & Electronics

This is a fast-emerging field for super-abrasives. Miniaturisation of devices, demand for wafer slicing, chip packaging, glass-lens machining and other precision steps mean that diamond and CBN abrasives are increasingly used in the electronics value-chain. Some reports suggest the electronics sector is rising in importance. Astute Analytica+1

Others (Medical, Aerospace, Industrial Manufacturing)

Beyond the main sectors above, niche end-users such as medical device manufacturing (surgical tools, implants) and aerospace (turbine blades, high-strength alloys) are critical for innovation in the super-abrasive market. These segments often drive higher-margin demand and push tool manufacturers toward advanced solutions (e.g., custom geometries, ultra-fine grits).

In summary, while transportation/automotive remains a base anchor of demand, growth is increasingly driven by electronics, heavy industrial and niche high-precision segments.

Application: Powertrain, Bearing, Gear, Tool Grinding, Turbine, Other Applications

The various applications of super-abrasives map to the functional manufacturing challenge; some applications dominate, others are growth niches.

-

Powertrain – This covers components such as crankshafts, camshafts, transmission housings, motor components (for EVs) and related parts. Super-abrasives are used in grinding and finishing these parts to achieve high surface quality and fatigue resistance. Reports show powertrain is one of the largest application segments. Reanin+1

-

Bearing – Bearings demand high accuracy, tight tolerance, and excellent surface finish for minimal friction and long life. Super-abrasives provide that capability in grinding bearing races and rollers. Reanin

-

Gear – Gears require complex tooth geometry, high surface finish, minimal defects and tight tolerances. The gear-grinding application of super-abrasives is growing fast, particularly in automotive and industrial machinery. Data Bridge Market Research

-

Tool Grinding – The grinding of cutting tools (e.g., carbide tools, drills, reamers) uses super-abrasives to sharpen or finish ultra-hard substrates. This application is a significant portion of the market. Data Bridge Market Research

-

Turbine – In energy and aerospace, turbine blades, disks and other high-performance components need super-abrasive finishing to ensure performance in extreme conditions – high temperature, high stress. Though smaller than automotive’s share, this is a high-value niche. Reanin

-

Other Applications – This might include stone/monument polishing, glass/ceramic finishing, mining tools, etc. These are smaller by share but can be innovation hotspots.

Overall, the application breakdown suggests that while tool grinding, powertrain and gear dominate volume demand, turbine and other specialised functions are strategic for the future—they push material and tooling advances that can trickle down to other uses.

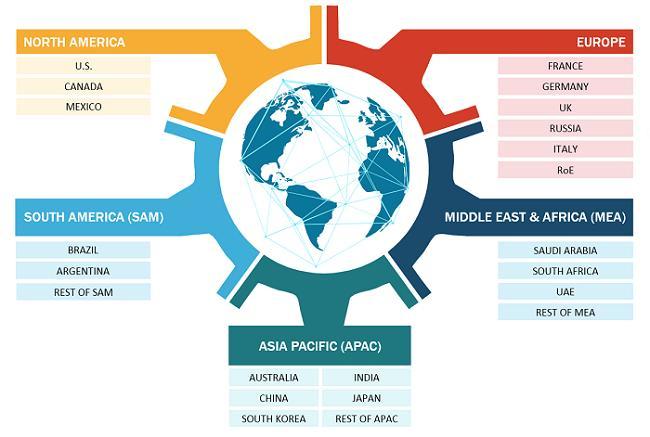

Geography: North America, Europe, Asia Pacific, South & Central America

Geographically the super-abrasive market shows distinct regional dynamics:

Asia Pacific

Asia Pacific leads in terms of share largely due to its large manufacturing base (automotive, electronics, infrastructure) and rapidly expanding industrialisation. For example, one report shows Asia Pacific held ~41% share of the market in 2024. Data Bridge Market Research+1 The region benefits from: low-cost manufacturing, high volume output, and strong demand for precision components (e.g., China, India, Japan, South Korea). Infrastructure build-out and EV adoption further boost regional demand.

North America

North America is characterised by high-end manufacturing (aerospace, medical, advanced automotive) and a strong emphasis on technology and premium tooling. The region is expected to grow at a faster rate in many forecasts (e.g., fastest CAGR in one study). Data Bridge Market Research+1 The U.S. in particular drives demand for advanced super-abrasive solutions, predictive wear monitoring, and customised tooling.

Europe

Europe, with its strong automotive heritage, precision engineering base (Germany, Switzerland, etc.) and investment in Industry 4.0, remains a major region for the super-abrasive market. Growth may be moderate compared with Asia Pacific, but the value-added nature of its manufacturing means demand for premium tools remains strong.

South & Central America

This region has a smaller share of the global market but is gradually expanding as industrial activity and infrastructure investment increase in countries like Brazil, Argentina and Mexico. Some reports indicate a modest but growing market presence. consainsights.com

In broad terms, the global picture is: Asia Pacific for volume growth; North America and Europe for premium/high-value demand; South & Central America (and other emerging geographies) for incremental and future growth.

Key Trends, Growth Drivers & Challenges

Growth Drivers

-

The push toward precision manufacturing: tighter tolerances, higher surface finish requirements, using harder and more exotic materials means super-abrasives become indispensable. Market.us+1

-

Rise of EVs and lightweight materials: as automotive shifts toward electric powertrains and composite structures, machining demands change, favouring super-abrasives.

-

Expansion of the electronics and semiconductor industries: wafer slicing, chip packaging, display glass finishing – all benefit from diamond and CBN tools.

-

Infrastructure and construction booms (especially in Asia) that require large volume cutting/grinding of concrete, stone, architectural glass and heavy machinery components.

-

Emergence of industry 4.0 and smart machining: integration of sensors, IoT, predictive wear monitoring in grinding/cutting centers encourages adoption of higher-performance abrasive tooling to match high-automation manufacturing. Intelevo Research+1

Challenges

-

Cost sensitivity: Super-abrasives are higher cost than conventional abrasives; in cost-conscious sectors the higher price can be a barrier. Astute Analytica

-

Availability/consistency of synthetic diamonds and CBN: while synthetic production has improved, supply chain constraints or raw-material costs can impact price and availability.

-

Rapidly changing material substrates: As newer alloys and composites emerge, tooling has to keep pace; this transition can be disruptive.

-

Energy consumption & manufacturing overheads: The production of super-abrasive tools (grinding, bonding, finishing) is energy-intensive, and fluctuations in energy or operational costs can affect profitability. Astute Analytica

-

Competing alternatives: While diamond/CBN dominate, other abrasive technologies (e.g., ceramics, coated abrasives, new hybrid materials) may encroach, especially in less demanding applications.

Outlook & Strategic Implications

Going forward, the super-abrasive market is on track for steady growth across all segments, but the shape of growth will differ by region, material type and application.

-

The diamond segment will likely remain the volume leader, thanks to its broad utility, but its growth rate may moderate.

-

The CBN segment is poised for stronger growth, especially in demanding ferrous-metal applications, gear and powertrain machining, and specialized manufacturing.

-

End-users such as electronics, medical devices, aerospace/turbine manufacturing will increasingly pull super-abrasive demand upward in value and technical complexity.

-

The Asia Pacific region will continue to dominate by volume, but North America and Europe will remain important for high-value premium tools and innovation.

-

Manufacturers and tool suppliers should focus on:

-

Customised abrasive solutions tailored for specific applications (e.g., EV motor machining, semiconductor wafer slicing).

-

Innovations in bonding, grit design, tool geometry, sensor-enabled wear monitoring to provide value beyond just hardness.

-

Expanding presence in emerging geographies (Latin America, Southeast Asia) to capture incremental growth.

-

Partnerships with OEMs in automotive, electronics, aerospace to co-develop tooling solutions aligned with evolving materials and manufacturing processes.

-

Conclusion

The super-abrasive market, though niche compared with standard abrasives, occupies a strategically important position in modern manufacturing. By material type, diamond remains dominant but CBN is gaining momentum; by end-user, transportation/automotive anchors demand, while electronics, oil & gas, and construction provide expansion opportunities; by application, powertrain, tool grinding and gear dominate the current share, with turbine and other high-precision applications carving new niches; and geographically, Asia Pacific leads in volume, with North America and Europe driving innovation and premium demand, while South & Central America offers emerging growth potential. For manufacturers and tool suppliers alike, the imperative is to stay ahead of substrate/material change, invest in application-specific innovation, and align offerings to the shifting global manufacturing landscape.

Also Available in: